Income Tax payers:

No changes in the old tax regime

New tax regime to become the default tax regime. However, citizens can opt for the old tax regime.

No tax on income up to Rs 7.5 lakh a year in new tax regime (with inclusion of standard deduction)

Govt proposes to reduce highest surcharge rate from 37% to 25% in new tax regime

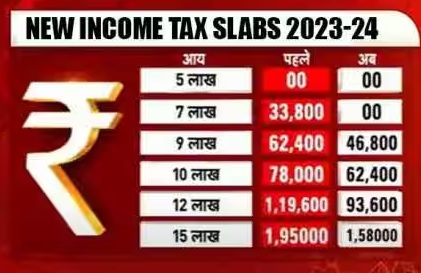

New Income Tax Slabs Under New Tax Regimes:

Rs 0-3 lakh: Nil

Rs 3-6 lakhs: 5%

Rs 6-9 lakhs: 10%

Rs 9-12 lakhs: 15%

Rs 12-15 lakhs: 20%

Rs Over 15 lakhs: 30%

An individual with annual income of Rs 9 lakh will have to pay only Rs 45,000 in taxes

Income of Rs 15 lakh will fetch Rs 1.5 lakh tax, down from Rs 1.87 lakh

A Rs 50,000 standard deduction to taxpayers has been introduced under the new regime

Payment received from Agniveer Corpus Fund by Agniveers to be exempted

Tax exemption removed in insurance policies with premium over Rs 5 lakh

For online games, govt proposes to provide for TDS and taxability on net winnings at the time of withdrawal or at the end of fiscal

Tax exemption on leave encashment on retirement of non-government salaried employees hiked to Rs 25 lakh from Rs 3 lakh.

A higher limit of Rs 3 crore for TDS on cash withdrawal to be provided to co-operative societies.

Next-generation Common IT Return Form to be rolled out for tax payer convenience

Grievance redressal mechanism to be strengthen.

TDS rate to be reduced from 30 per cent to 20 per cent on taxable portion of EPF withdrawal in non-PAN cases

- Use of AI for Small Business: A Game Changer for Growth

- Godrej Remains Top Security Brand in India, Aims for 15% Urban Market Share

- Grand Launch of ‘Marathi Udyojak Abhiman Geet’ at Bombay Stock Exchange

- Smart Home Cameras Boost Women’s Confidence: Godrej Survey

- Baskin Robbins India Expands to Tap Quick Commerce, Snacking Boom